This review is on the Allianz Benefit Control Fixed index Annuity. The Purpose of this review is to show you where Allianz Benefit Control Annuity is strong and where it has weaknesses, so that you can make an informed decision, considering all available facts.

- Product type

- Fees

- Investment options that are available and their Realistic long-term investment return expectations

- Understanding the income rider

- How it can best help you as part of your financial plan

Allianz Benefit Control Annuity Quick Facts

| Product Name | Allianz |

| Issuer | Allianz Life Insurance Company |

| Type of Product | Fixed Indexed Annuity |

| Standard & Poor’s Rating | “AA” (Very Strong) |

| Phone Number | 888-266-8489 |

| Website | www.Allianzlife.com |

There are a few ways that Agents might pitch this product.

- To get guaranteed Lifetime income that has the potential to increase

- Earn interest while having no risk of losing money in the market

- Create a lifetime guaranteed income that can increase over time

- 10% bonus on your premium

- Potential to receive income increases

- Double your withdrawals with Allianz Income Multiplier benefit

- Lock in Index performance

Is any of this true?

The Allianz Benefit Control Fixed Index Annuity is definitely unique and is strong when it comes to the potential the annuity has to deliver over time. It has unique features that most annuities in the industry don’t have. Also known as ABC annuity, is an index annuity which means it tracks the S&P 500 not invest in it, consequently you will earn interest when it goes up and protect you with zero downside when the market goes down.

The Allianz Benefit Control Annuity offers three ways to receive interest, (1) Index Interest, (2) Fixed Interest, (3) Combination of both. Because it’s a fixed annuity, it gives you the potential to earn indexed interest based on changes in your choice of several indexes and crediting methods. Crediting methods determine how much intertest your annuity earns, based on the changes in an external market index, or, if you prefer, Allianz Benefit Control lets you receive fixed interest instead. Allianz calculates and credits fixed interest daily, based on a rate they established and last but not least you also have the option to choose a combination of fixed a potential indexed interest.

One of the best features of this annuity is the potential to capture interest with the index lock feature, which lets you lock in an index value on an indexed interest allocation at any point during the crediting period, this means that by locking in your index value you are guaranteed with a positive index credit, no matter what happens in the market during the remaining crediting period.

Before we go in the details, here is an important legal disclosure.

This is an independent review at the request of readers. So they could see my perspective when breaking down the positives and negatives of this particular model annuity. This is an independent product review, not a recommendation to buy or sell an annuity. Allianz has not endorsed this review in any way, nor do I receive any compensation for this review. Before purchasing any investment product be sure to do your own due diligence and consult a properly licensed professional, should you have specific questions, as they relate to your individual circumstances. This is not meant to be specific advice. Your advisor may know more about your circumstances to make an appropriate recommendation. All names, marks, and materials used for this review are property of their respective owners.

Some information on Allianz

Allianz Life Insurance Company of North America (Allianz) is a leading provider of retirement solutions, including fixed and variable annuities and life insurance for individuals. Variable annuity and variable life insurance guarantees do not apply to the performance of the variable subaccounts, which will fluctuate with market conditions.

Guarantee Life Income?

Allianz Benefit Control Annuity provides you with a guaranteed income and the opportunity for income increases. To help address inflation, higher taxes and medical expenses, ABC annuity offers income increases every time your contract earns interest.

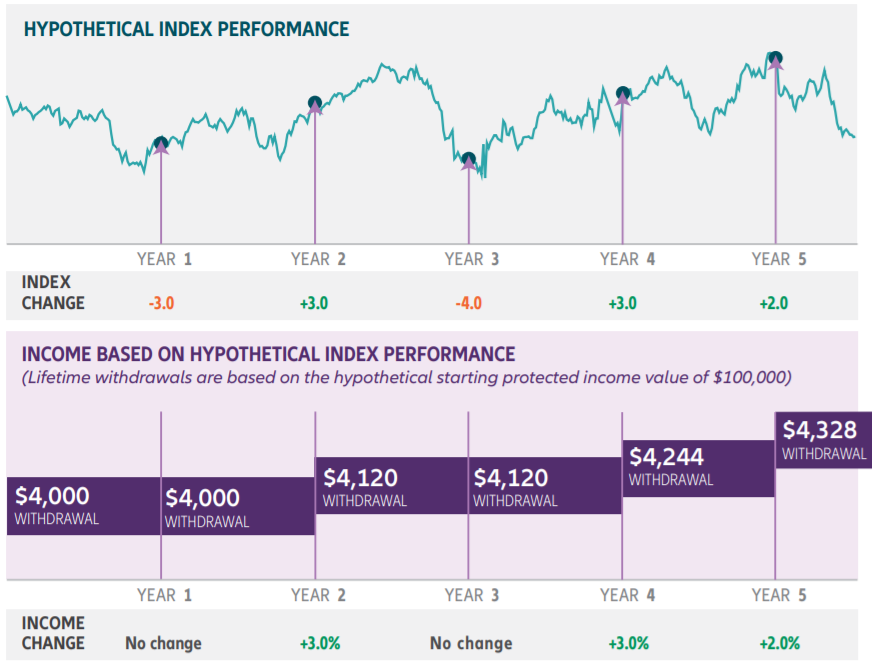

Below there’s a hypothetical example that shows how increasing income works:

This annuity is a long-term commitment with high penalties if you take your money out early.

The penalties are below.

| Contract years | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Withdrawal Charge | 9.30% | 9.30% | 8.30% | 7.30% | 6.25% | 5.25% | 4.20% | 3.15% | 2.10% | 1.05% |

How does the Bonus Control Benefit work?

Before getting into details you should understand these concepts:

Protected Income Value (PIV): This is taken into consideration when you plan to take lifetime withdrawals. Also, you can take this value as a lump sum.

Accumulation Value (AV): This is the amount you can take out of your annuity as a lump sum, after the withdrawal charge period.

The Allianz Benefit Control allows you during the accumulation phase to control how interest is credited with two primary options.

Option 1:

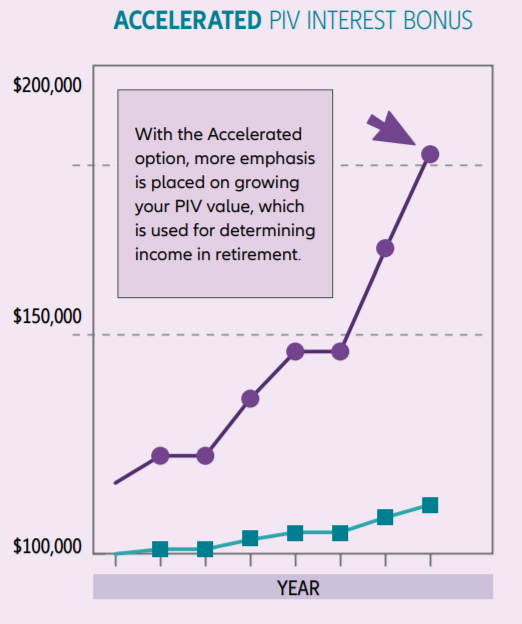

Accelerated PIV Interest Bonus

It allows them to more aggressively pursue income savings goals with a 250% interest bonus to your PIV and a 50% accumulation value interest factor. For example, two and one-half times any interest you earn is credited to your PIV, and half any indexed interest is credited to your accumulation value while you are saving.

To better understand this, below there’s a graph that shows you how your PIV grows more in proportion to your AV:

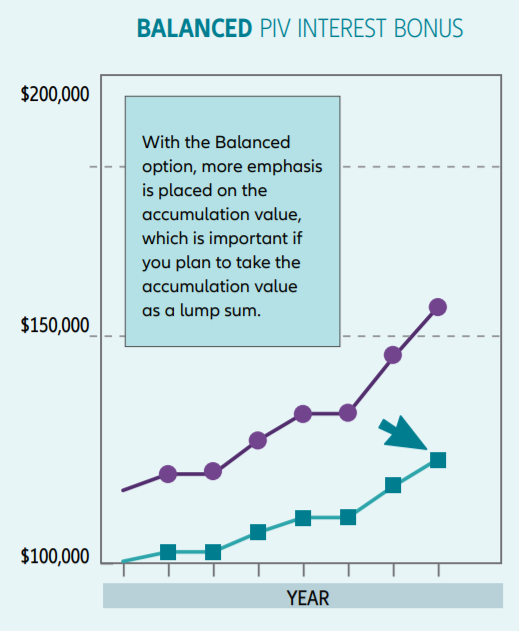

Option 2:

Balanced PIV Interest Bonus

This option focuses on growing the accumulation value. With this option, you can take a more balanced approach to pursuing your annuity values with a 150% PIV interest bonus and a 100% accumulation value interest factor. So one-half times any interest you earn is credited to your PIV, and all of the interest you earn is credited to your AV, as result your PIV’s growth is more modest in proportion to the AV.

.What type of Performance can I expect from the options inside the Allianz Benefit Control Annuity ?

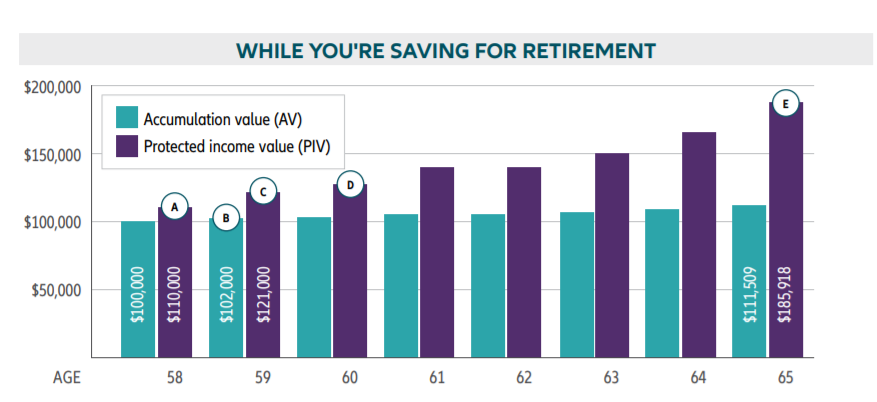

To better understand the performance of this annuity let’s take a look at this hypothetical example during The Accumulation Phase.

John is 58 years old and would like to retire at 65, assuming he buys the ABC for $100,000, the annuity immediately adds a 10% bonus to his PIV, so he’d have $110,000 right away. John’s allocation earns 4%, his AV will be credited with 2%, this is happens because the accumulation value interest factor of this Accelerated PIV bonus option is 50%. Meanwhile, with the Accelerated PIV bonus, he will receive a bonus equal to 250% of the 4% credit, meaning her PIV will be credited by an additional 10%, this brings his protected income value to $121,000 for the first year.

Assuming the Index John selected got a negative performance, his contract will not go down since his AV and PIV are protected.

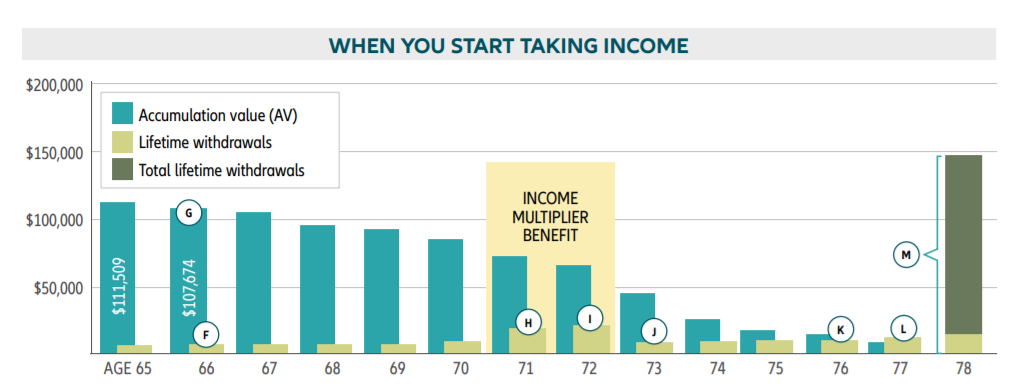

Now John is 65 and wants to start taking lifetime withdrawals. John starting payout at 65 is 3.75% because his PIV grew up to $185,918 so his lifetime withdrawal will begin with $6,972. This lifetime withdrawal will never decline as long as John does not withdraw more of that amount per year.

What happens during The Income Phase?

In this same example, as John starts lifetime withdrawal, his withdrawal amount can increase anytime his allocations earn interest. Assuming John’s allocation options earn a 3% interest credit during his first year taking income. With the 150% interest bonus, his income will increase by 4.5% from 6,972 to $7,286 when he is 66. Also, his accumulation value will receive a 3% credit increasing to $107,674.

At age of 70, John suffers an injury and is unable to perform two activities of daily living. Since the contract includes the Allianz Income Multiplier benefit, beginning on his next contract anniversary, his withdrawal amount doubles from $9,196 to $18,392 for the two years it takes to recover. John contract increases to $19,496, then when he recovers his withdrawal amount will be reduced to half of the $19,496 ($9,196).

John’s withdrawal amounts will never go down and when they go up, they are locked in at the higher level. When he is 77 years old all AV has been distributed to him, however, he will continue to receive income through guaranteed withdrawals as promised in the contract.

Annuity Edu’s Summary on the Allianz Benefit Control Annuity

Where it works best:

- For those who need guaranteed lifetime income

- Producing a pension like lifetime guaranteed income stream that has the potential to increase

- Earn interest while having no risk of losing money in the market

- Those looking for income increases

- Those who want to maintain flexibility in retirement

Where it works Worst:

- For those who need liquidity

- Those who need a return on their investment in the first decade of retirement if using Income rider

- Need to access your money during the annuity’s surrender period

My Insight

Overall, I think this annuity has some really good features. The Annuity allows flexibility to begin income at any time as well as it offers you the option to lock in index performance. The only thing that concerns me is the minimum free annual withdrawal which is only 3.75% of the total Accumulation Value, so in case the person needs more money for that year he or she will have to face the surrender values of this annuity. It’s important to understand these numbers going in. Buying an annuity is a long term commitment and it’s important to test this annuity versus various others to see which one fits your goals and objectives the most. This is something we do for free here at Annuityedu.com.

We’ll use our proprietary calculator to illustrate for you how this annuity will likely perform in your specific situation.

Click here to Test my Annuity, If your agent was honest with you, the numbers will match up – if not, well at least you know before you buy.

To Conclude

Unfortunately, I think advisers may be overestimating the returns you’ll receive. That’s why we can help you test the guarantee in your financial plan and for the internal rate of return it provides and see if your plan can handle it. This isn’t to say that having the Allianz Benefit Control may not be a good way to meet your financial objectives with a portion of your dollars. It might, but it’s only possible after testing it that you’ll know.

Have Questions on Allianz Benefit Control Annuity? Have any comments?

Do you have any questions that you can’t seem to find the answer here on our website? [You can send us your questions here via our Free Annuity Help contact form].

Purchasing an annuity is often an irreversible decision and usually you will have high surrender fee’s if you decide to change your mind after you buy it.